The conversational AI in the insurance market will surge to USD 12.19 billion by 2033, but insurance customer service has a reputation problem.

Long wait times, confusing portals, and inconsistent customer support have eroded the patience of today’s digital-first policyholders. Natural disasters, seasonal spikes and open enrollment periods can push teams to the breaking point.

Bottom line: traditional customer service models can’t scale. But using conversational AI in insurance can.

An AI customer service agent acts as your frontline policyholder rep. It can process updates, answer questions, and deliver real-time support across channels at scale.

Conversational AI and chatbots have already delivered 1.3 billion in claims processing savings and reduced manual efforts by up to 73%.

At Retell, we’ve seen firsthand how the insurance industry is using including outbound outreach capabilities like AI telemarketing conversational AI to reduce support volume and accelerate sales cycles. In this article, we’ll explore the top benefits, real-world use cases, and key capabilities to look for in conversational AI vendors in the insurance sector.

What Is Conversational AI in Insurance?

Conversational AI in insurance is designed to handle complex claims inquiries, policy questions and premium calculations that require specialized knowledge. They combine natural language processing (NLP) and machine learning to mimic human interactions.

Unlike traditional sales and support systems, conversational AI in insurance can:

- Process and respond to both text- and voice-based natural language inputs

- Learn from previous interactions to continually refine future responses

- Interpret complex and detailed questions around insurance policies and coverage

- Adapt tone and responses by recognizing emotional cues in conversations

- Offer personalized recommendations using customer-specific data

On average, calls to an insurance call centre typically break down as follows:

- 55% are about obtaining information

- 35% are about executing a transition

- 10% are about resolving an issue

Rather than having humans handle nearly 80% of all insurance calls on their own, automation will work alongside agents to reduce purely human-led interactions to as little as 10%.

The goal is to create a smarter, faster contact center, where automation shifts interactions from being entirely human or entirely digital to a more effective, blended model that combines both.

Why Insurance Needs Conversational AI in 2026

For decades, the insurance industry has relied on an agent-driven model that no longer aligns with modern digital expectations. Customers today demand seamless, instant experiences, yet insurance remains a time-consuming purchase.

That’s the core driver behind the rise of Conversational AI in insurance.

1. High customer expectations

The insurance industry faces a devastating 84% cart abandonment rate, and the average quote-to-policy conversion rate hovers between just 10%-20%. Many leads drop off within the first 24–48 hours unless followed up on quickly.

Unfortunately, most traditional systems struggle to deliver that without burning out staff or inflating costs; they rely on:

- Manual follow-ups via calls and emails, often delayed by hours or days

- One-size-fits-all messaging that lacks personalization

- Disconnected channels (CRM, call center, email tools don’t sync well)

- Inconsistent follow-ups due to workload, shift changes, or attrition

Brokers seek tools that enhance transparency and deepen client relationships; meanwhile, policyholders demand more personalized products and service models tailored to their unique needs.

The rise of conversational AI and real-time conversations reflects this shift. The ability to offer frictionless digital experiences and responsive support will become key differentiators in 2026 and beyond.

2. Overcome operational challenges

Slow claims processing is more than an inconvenience for insurers. Yet, nearly 74% of insurance companies still rely on outdated legacy systems for critical processes, resulting in manual workflows and data siloes that delay claims and increase operational challenges.

To make things more complicated, long wait times do more than irritate customers. Once, customers who wait around 13 minutes for someone to answer the phone. Now, they’ll barely wait one minute before hanging up.

But customers abandoning calls is just the tip of the iceberg. Every second added to your call center wait time or claim processing has a negative impact on customer satisfaction and operational costs.

These problems don’t fix themselves. Long wait times create a vicious cycle. More calls lead to longer queues, which lead to more callbacks and escalations. If you don’t stop now, customer experiences and your reputation just keep degrading.

3. Rise of AI market adoption

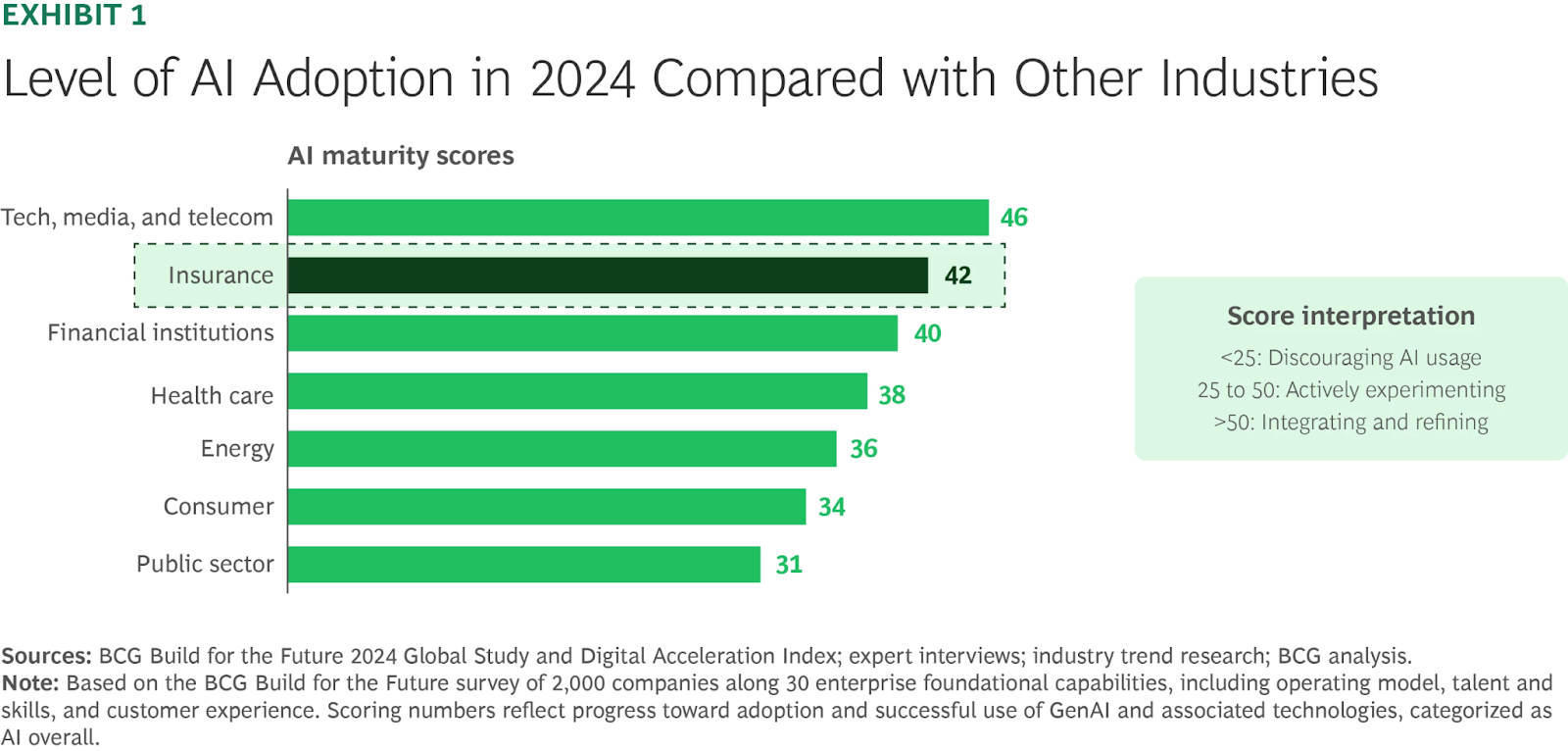

The insurance industry has made substantial progress in adopting, piloting, and scaling predictive and generative AI systems, including AI agents. A recent survey shows that insurance companies are outpacing most other industries and reaching adoption levels comparable to those in technology, media, and telecommunications.

Recent reports suggest that 80% of insurance leaders are under increasing pressure to streamline operations and have identified AI as a top strategic initiative for 2026.

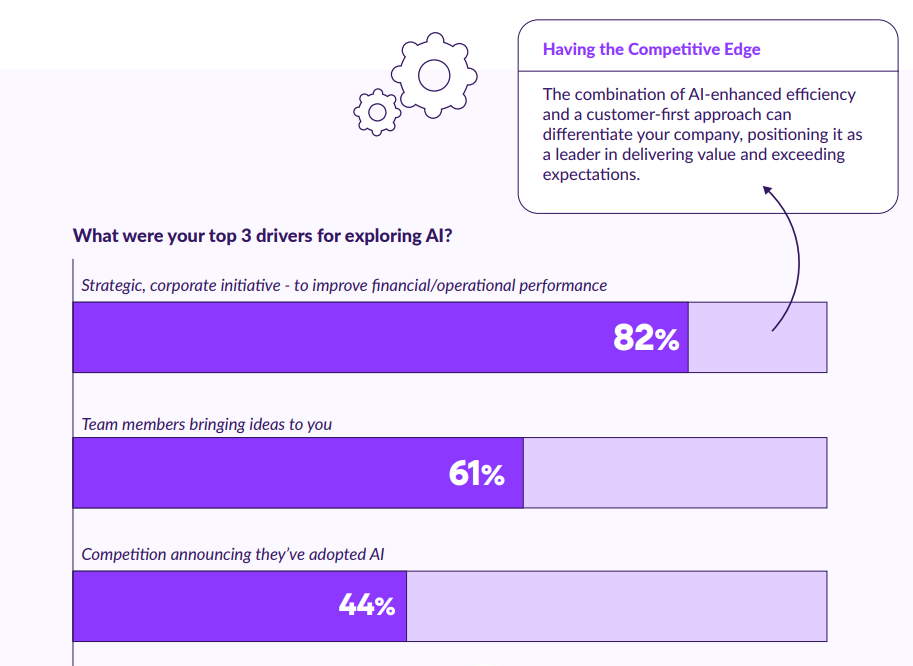

The top driver for adopting AI is enhanced efficiency and reduced costs while also staying ahead of the competition.

The data shows that nearly two-thirds of respondents believe AI initiatives can remove repetitive, high-volume tasks, freeing teams to spend more time on higher-value work.

The leading use cases for AI that IT professionals are exploring are:

- Processing unstructured data/ documents (67%)

- Workflow/process automation (60%)

- Processing structured data/documents (38%)

- Risk assessment and/or scoring (24%)

- Customer/agent/broker support (23%)

Studies of the insurance industry highlight significant benefits from AI adoption. For instance, top-performing insurers that provide service and operations teams with AI-powered knowledge assistants have increased productivity by over 30%. They are also creating personalized agents for customer support.

How Conversational AI Transforms Insurance Workflows

Insurance may be built on trust, but it’s bottlenecked by inefficiency.

Conversational AI walks users through claims and virtual agents, handing out real-time quotes in an instant, making the whole process faster and more personal. In fact, digital conversational solutions are delivering measurable impact, cutting query response times by as much as 80%.

Now that we’ve set the stage, let’s break down how conversational AI helps:

1. Claims and First Notice of Loss (FNOL)

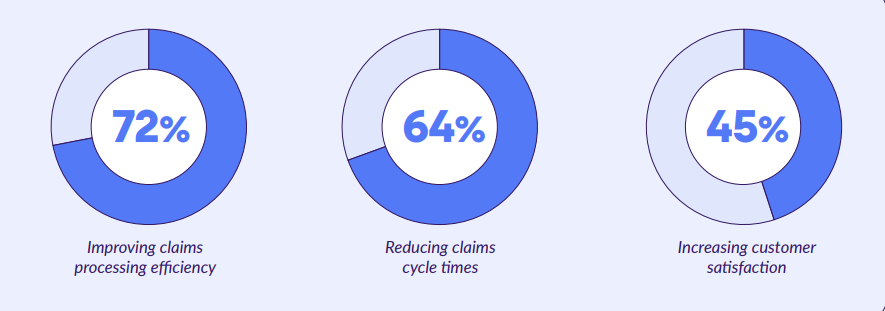

The top priority of claims professionals for 2026 is improving:

- Claims processing efficiency (72%)

- Reducing claims cycle times (64%)

- Increasing customer satisfaction (45%)

These priorities directly align with conversational AI’s potential to drive improvements in these areas.

AI agents including an AI voice agent can handle FNOL calls end-to-end, answering the call, qualifying the customer, and collecting and confirming all required information. The AI then analyzes the conversation and seamlessly hands over a complete, structured summary to a human agent for final resolution.

This can help your insurance company reduce manual costs by 70% and make claim processing simpler.

2. Underwriting and risk assessment

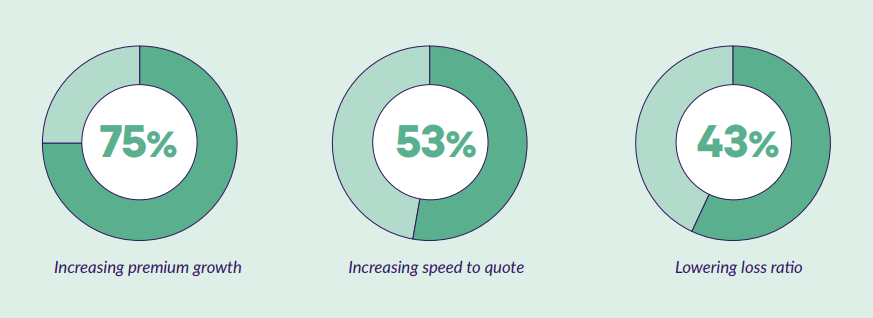

According to a recent report, the top priorities of underwriting professionals are:

- Increasing premium growth (75%)

- Increasing speed to quote (53%)

- Lowering loss ratio (43%)

For increasing speed-to-quote (53%), conversational AI can automate many of the manual tasks involved in the quoting process, such as data gathering, risk evaluation, and document processing.

AI models can more precisely forecast potential risks by analyzing historical data, market trends, and a wide range of other variables that influence risk exposure.

3. Customer support automation

Fortune 500 insurance companies usually have an enormous customer base, leading to tens of millions of calls each year. When handling such a vast number, long hold times, inconsistent communication, and huge operational costs are common challenges.

Conversational AI bots excel at resolving queries and providing immediate assistance through:

- Delivering real-time updates on billing, coverage, payment deadlines, and document access

- Helping users complete routine tasks such as password resets or address updates

- Securely verifying customer identity before sharing sensitive policy information

- Automatically recording requests in CRM or ticketing systems to ensure seamless follow-ups.

For insurers, this translates to shorter wait times, lower support costs, and higher customer satisfaction.

4. Fraud detection

According to Insurance Europe, fraud costs insurers some US$14 billion a year — it is a pressing and insidious problem. AI voice bots can quickly analyze data connections to detect fraud, even in complex conversations.

AI voice agents typically detect fraud in three primary ways:

- During live calls, they continuously monitor for recognizable patterns and signals that may indicate fraudulent behavior.

- They perform comprehensive link analysis and document evaluations to assess the credibility of the caller’s claims.

- Conversational AI systems constantly learn from new data, identifying emerging patterns and trends to prevent fraud proactively.

Because conversational AI is deeply integrated across an insurance company’s ecosystem, it can easily cross-reference customer information from multiple systems, enabling a more accurate and holistic fraud assessment.

5. Omnichannel presence

Study reveals omnichannel experience creates higher levels of engagement and customer satisfaction. Policyholders who utilize multiple channels are 21% less likely to cancel their policies, and customers who repeatedly use them have a 25% higher retention rate.

An AI-powered virtual assistant can engage with customers on the insurer’s website, Android or iOS app, or messaging platforms. With the AI Agent's omnichannel capabilities:

- Customers can respond directly to confirm renewals or ask questions

- Policyholders receive timely, proactive reminders for renewals, premium payments, and documentation across their preferred channels

- Personalized messages and recommendations based on customer behavior, policy type, and interaction history

- Unified data across channels gives insurers a complete view of customer interactions, enabling smarter follow-ups and targeted retention strategies

A two-way conversation across channels enables faster issue resolution, reducing drop-offs during critical moments like renewals or claims.

Benefits of Conversational AI for Insurance Companies

Regardless of your product or service, customers expect access to personalised support conversations across channels. This is precisely what conversational AI helps you deliver in the insurance sector — redefining how you interact with customers without breaking the bank.

1. Operational efficiency and cost reduction

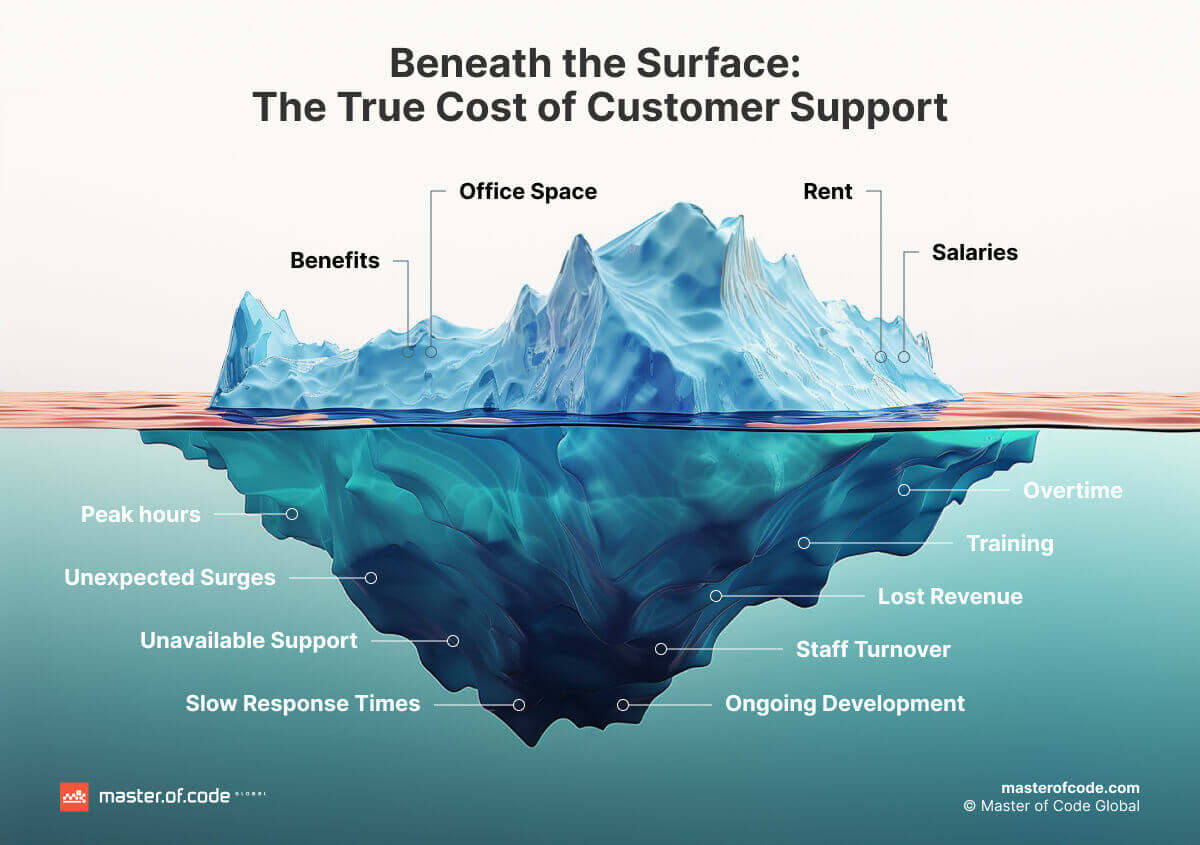

Traditional consumer service models, while seemingly straightforward, are riddled with hidden expenses that quietly erode your bottom line.

But the financial impact doesn’t stop here. In today’s digital age, slow response times and unavailable customer support are simply unacceptable.

Conversational AI, with its ability to simulate human language, is a master of automation such as processing policy inquiries and handling standard claims, and liberates staff from repetitive duties.

2. Faster processes and shorter cycle times

Long claims cycle times are still a top challenge in the insurance industry. For example, auto repair claims now take an average of 23.1 days to settle—more than twice as long as before the pandemic. The delays incurred have a direct effect on the customer’s trust and so turn them into churners.

Conversational AI reduces bottlenecks. Instead of waiting for days for human data validation or manual inspection, AI voice bots instantly capture structured information, validating policy details, and flagging missing data in real time.

AI reduces human touch points and achieves a 78% reduction in processing time, with simple claims completed in under 24 hours.

3. Better data quality and decision-making

AI-powered conversational voice bots deliver deep visibility into customer behavior, pain points, and preferences.

By recording and analyzing customer calls, voice bots help you:

- Identify emerging trends and recurring issues

- Uncover upsell and cross-sell opportunities.

- Ensure agents consistently ask the right questions.

- Verify adherence to scripts and prompts designed to drive revenue.

Beyond individual interactions, you can track agent performance to understand the overall customer experience better. Voice bots surface actionable metrics such as:

- Average call volumes per day

- Total talk time

- Detection of predefined keywords and phrases within conversations

- And more

This insight-led approach enables smarter decision-making and more personalized customer interactions, ultimately strengthening loyalty and improving retention.

Benefits of Conversational AI for Insurance Holders

Insurance customers don’t have complicated needs. They want smooth, hassle-free interactions and clear, transparent information. The insurers that do all these things well earn the trust and loyalty of their customers.

Policyholders want to experience:

- Timely answers to urgent questions.

- Personalized updates that make them feel seen and valued.

- An ongoing relationship with their insurer—not just transactional interactions.

And when the dust settles, they’ll remember who stood by them.

1. 24/7 instant support on any channel

According to Bain’s survey of more than 174,000 retail insurance consumers in 18 countries, insurance customers around the world value quality and ease of use.

The share of customers using browsers and apps on mobile phones has increased by an average of more than 70%. In China, nearly 70% of millennial life insurance customers used their smartphones for research or interactions in the past year.

Conversational AI enables insurers to meet these expectations by offering a unified customer communication, whether they’re on phone, chat or messaging apps—without waiting on hold, AI IVR systems, navigating IVRs, or adjusting to office hours.

Look for platforms like Retell AI that commit to 99.99% uptime and have resilient fallback mechanisms to minimize service disruptions.

2. Faster answers during stressful moments

When people face uncertainty, clarity is power. Insurance policyholders aren’t just looking for policy updates—they’re looking for peace of mind.

They want to know:

- Is my coverage changing, or am I still fully protected?

- How do I access my benefits or file a claim when I need to?

- What can I do proactively to reduce my overall policy costs?

- Can I trust that my provider is genuinely looking out for my best interests?

Conversational AI delivers that reassurance instantly. It responds quickly and presents information in clear, understandable ways, helping insurers build loyalty through empathy and responsiveness.

3. Accessibility and language support

According to research published by Forbes, effective communication in a customer's native language significantly improves interaction quality and builds stronger relationships.

What exactly constitutes multilingual customer support in insurance? It goes far beyond simple translation.

For insurance agencies, this means:

- Offering claims assistance across multiple languages

- Providing policy explanations in clients' native languages

- Ensuring policy documents are accessible to diverse language speakers

- Creating culturally appropriate communications that respect linguistic nuances

The impact of implementing these systems is significant. An ICMI report cited by Hiver reveals that 72% of customer service leaders see higher customer satisfaction when clients can describe issues in their native language. This statistic alone should make insurance agencies take notice.

Cutting-edge platforms like Retell AI now support 50+ languages with natural, native-sounding speech and can automatically detect and switch to a caller’s preferred language in real time.

Key Capabilities to Look For in Insurance Conversational AI Platforms

When evaluating conversational AI vendors, insurers should look beyond surface-level demos and marketing claims.

The right platform should deliver measurable operational value, regulatory confidence, and consistently strong customer experiences, especially in high-stakes moments like claims, renewals, or policy changes.

| Features | Why it matters | Look for a conversational AI vendor that offers |

|---|---|---|

| Language Understanding, Speech Quality, and Multilingual Support | Poor language understanding or robotic speech quickly erodes trust and increases call deflection to human agents. |

|

| Deep Integrations with Policy, Claims, CRM, and Billing Systems | Conversational AI delivers ROI only when it can do things—fetch data, update records, and complete transactions end-to-end. |

|

| Security, Privacy, and Regulatory Compliance | Insurance conversations contain highly sensitive data and must meet strict regulatory and security requirements. |

|

| Orchestration, Routing, and Human Handoff | Insurance journeys are rarely linear. The AI must manage complexity and know when to escalate—without forcing customers to repeat themselves. |

|

| Analytics, Reporting, and Optimization Loops | Conversational AI is not “set and forget.” Continuous measurement and optimization separate high-performing programs from stalled pilots. |

|

Case Study: How Matic Uses Retell AI to Automate Critical Insurance Call Workflows

Matic is a nationally recognised digital insurance agency that partners with many of the largest mortgage servicers and financial institutions in the U.S.

Matic’s call operations were under pressure. With 120,000 monthly calls, even small inefficiencies created significant operational overhead. The team faced several persistent problems:

- Inconsistent experiences after hours through an outsourced third-party call center

- Time sucked dialing into unanswered calls and voicemails

- Tasks such as data collection required Matic's agents to spend 7–9 minutes per call gathering data before even starting the quote process

Matic needed a way to operate more efficiently—without sacrificing the service quality expected by their partners or their customers. Retell conversational AI voice bot helped Matic solve several persistent problems:

Use Case 1: After-Hours Coverage

Before Retell AI, Matic relied on third-party call center vendors to handle after-hours calls. The performance was poor, and customer experience suffered exponentially.

With Retell AI, Matic launched 24/7 available voice agents for lead qualification and handles all incoming after-hours traffic. AI phone agents ensured that there was a consistent, branded first touch for every caller, no matter the time, day, or call volume.

Use Case 2: Appointment Confirmation & Rescheduling

Scheduling delays and missed calls were costing Matic valuable opportunities.

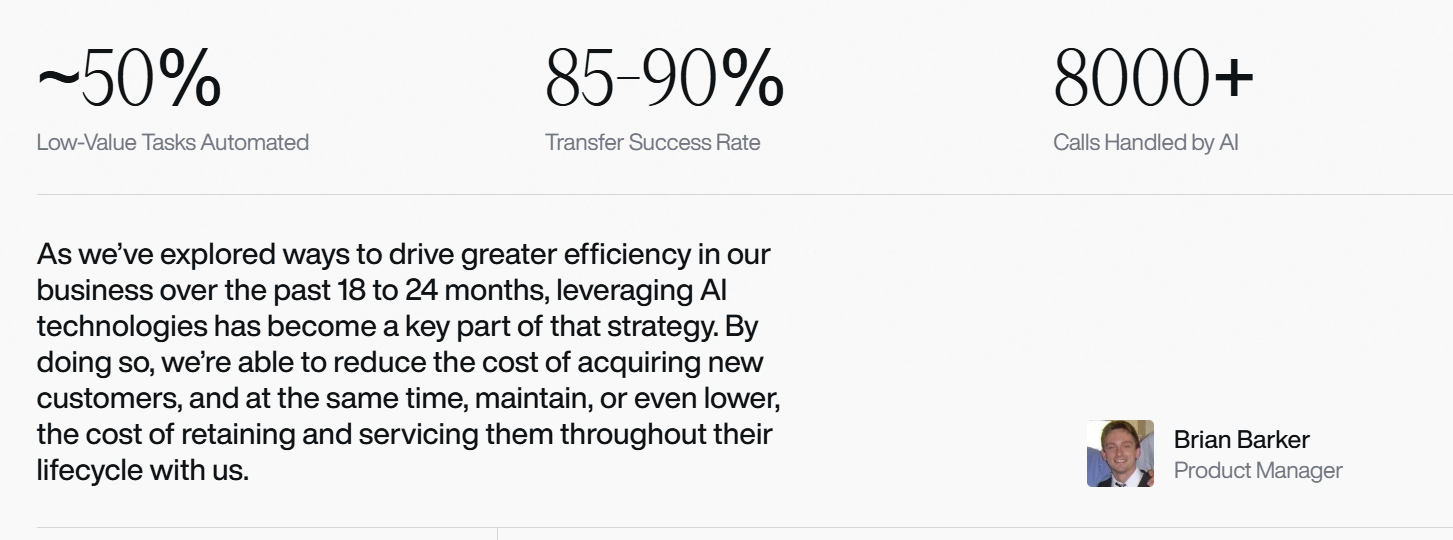

Retell AI solved this by handling scheduled call follow-ups automatically. With this powerful automation, Matic has seen:

- Handles 3,000–4,500 scheduled calls each month

- 85–90% success rate in transferring calls to licensed agents

- Consistently higher answer rates than human-led outreach

Use Case 3: Data Collection & Lead Qualification

Quote intake was one of the most repetitive and time-consuming parts of Matic’s call operations. It took 7-9 minutes per human agent before even getting to the consultative part of the conversation.

With Retell AI, that entire process is now automated:

- Agents avoid time-consuming calls with ineligible or unqualified leads, improving overall efficiency

- Data collection time was reduced from an average of 9 minutes to approximately 6 minutes

- Product and eligibility rules can be updated quickly, allowing the system to adapt as requirements change

Conversational AI impact on Matic

- Calls handled by AI in Q1 2025: 8,000+ across all use cases

- Transfer success rate for scheduled appointment calls: 85–90%

- Higher answer rates for AI calls vs. human calls (from A/B testing)

- Call handling time reduction in data intake flows: ~3 minutes

- Low-value tasks automated and reassigned: ~50%

Conversational AI in the insurance industry is raising the bar

AI voice agents are quickly becoming the backbone of how insurance leaders deliver service.

Retell AI's voice agents provide the perfect AI voice call solution–handling routine calls, routing complex inquiries, and freeing up human agents on low-value tasks.

- Zero-latency conversations

- High-accuracy transcription & text-to-speech

- ElevenLabs voice integration

- Live response generation & action execution

- Intelligent call routing, logging, and transfers

- CRM integrations

- Enterprise-grade customer support

As call volumes grow and customer expectations evolve, implementing an AI contact center guarantees a competitive advantage in an increasingly automated business landscape.

AI voice agents are quickly becoming the backbone of how insurance leaders deliver service. Schedule a personalized demo to see our AI voice agents in action and learn how they integrate with your existing systems.

FAQs

1. What is the difference between conversational AI and a chatbot in insurance?

Chatbots follow scripted flows. Conversational AI understands intent, manages complex dialogues, integrates with core systems, and adapts responses dynamically across insurance use cases.

2. Will conversational AI replace human insurance agents?

No. Conversational AI handles routine tasks and data collection, while humans manage complex decisions, empathy-driven conversations, and final accountability for policy and claims outcomes.

3. How long does it take to implement conversational AI at an insurer?

Pilots typically launch in 4–8 weeks. Full rollouts take 3–6 months, depending on integrations, compliance requirements, use case complexity, and internal governance readiness.

4. How secure is conversational AI for handling sensitive insurance data?

Enterprise platforms use encryption, role-based access, secure deployments, audit logs, and regulatory compliance controls to protect sensitive policyholder and claims data.

5. Should we build our own conversational AI or buy a platform?

Building offers control but demands time and talent. Buying accelerates deployment, reduces maintenance, ensures compliance, and scales faster with lower long-term risk.

6. How does conversational AI fit into our broader digital transformation roadmap?

Conversational AI acts as a front layer connecting modernized cores, CX initiatives, and data strategies, accelerating automation, insights, and consistent experiences enterprise-wide.

See how much your business could save by switching to AI-powered voice agents.

Your submission has been sent to your email

ROI Result

Total Human Agent Cost

AI Agent Cost

Estimated Savings

A Demo Phone Number From Retell Clinic Office